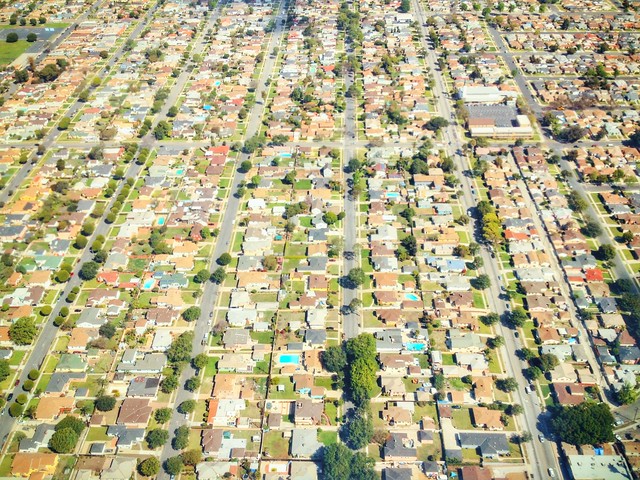

In the past, shopping for a house to buy involved calculating how difficult your commute to work would be. Whether it was measuring the distance to public transportation, the nearest highway, or timing the total drive, home buyers had to consider their daily routine before making an offer. Then, COVID hit and changed everything. Now, with more Americans working from home, commutes are becoming less of a factor in home buying decisions and it’s changing how and where we buy. For example, a recent survey found that 40 percent of Americans who have recently moved or plan to soon are relocating more than 100 miles away – half of them are moving over 500 miles away. Additionally, real-estate professionals report that they are seeing more city-to-suburb moves and are getting far fewer requests for homes close to transportation options. And now it’s looking like the change will be permanent. In fact, three out of four consumers who have moved or are planning a move say they don’t plan to return to the area where they lived pre-pandemic. (source)