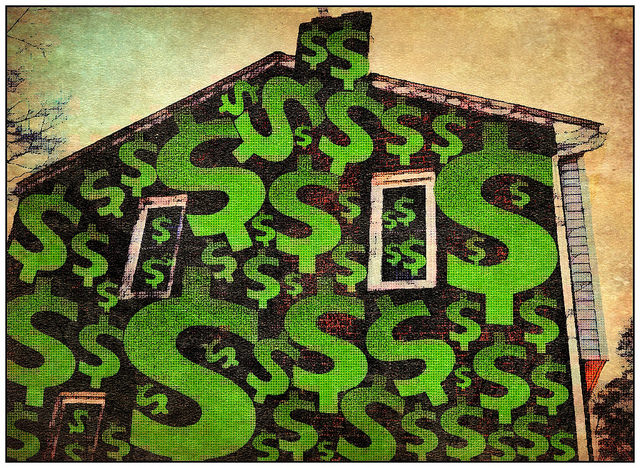

When debating whether to rent or buy your next place, the argument in favor of renting usually includes the fact that it’ll be cheaper – especially since you don’t have to pay for closing costs or save for a down payment. However, renting a place isn’t all that cheap these days and, depending on what you’re looking for, prices may be rising even faster than expected. According to recently released data, rental rates are increasing and particularly among two and three-bedroom homes. In fact, rental homes, generally, are climbing in price faster than apartments. Nationally, a typical two-bedroom now costs $1,310 per month and the cost for a typical three-bedroom is up to $1,445. And, depending on your local market, it could be even higher. So why is rent rising faster for homes than it is for apartments? Well, for some of the same reasons home prices are climbing. For one, new, and smaller, apartments are the focus of most rental unit construction, while the supply of single-family homes to rent is mostly fixed. More here.