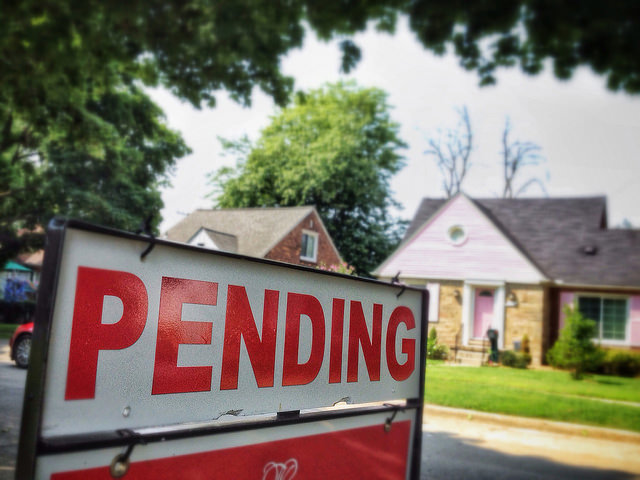

The National Association of Realtors’ Pending Home Sales Index measures the number of contracts to buy homes signed each month. Because it tracks contracts, not closings, it’s considered a good indicator of where home sales are headed. In August, the index registered a 2 percent decrease, marking the third consecutive month of declines. Lawrence Yun, NAR’s chief economist, says mortgage rates are the number one factor with buyers. “The direction of mortgage rates – upward or downward – is the prime mover for home buying, and decade-high rates have deeply cut into contract signings,†Yun said. “If mortgage rates moderate and the economy continues adding jobs, then home buying should also stabilize.†Yun expects mortgage rates to become more steady once inflation calms. That, and slower price appreciation, should lead sales to pick up. Regionally, August’s results show contracts to buy homes were down in the Midwest, Northeast, and South, but rose in the West. (source)