The commercial real estate sector is depend heavily on financial metrics, which are crucial indicators for making informed investment decisions. The capitalization rate, or the cap rate, is one such significant metric that helps determine the value of an investment. This term is of utmost importance in evaluating property profitability. It serves as a practical guide for investors in their buying and selling decisions, empowering them with the knowledge to make sound investment choices.

The cap rate is a powerful tool for assessing a property’s expected ROI (return on investment). This metric provides insights into how well the property generates income relative to its value and serves as a benchmark for comparing other investment opportunities. By understanding and using Capitalization Rate, investors can feel confident in their ability to analyze and compare different investment prospects.

In this blog, we will discuss the cap rate in greater depth, the formula to calculate it, its importance, and how it can be used to make sound decisions when investing in Commercial Real Estate.

What Does Cap Rate Mean in Commercial Real Estate?

In the commercial real estate field, the capitalization rate, which in ordinary words is referred to as the Capitalization Rate, is a metric that reflects returns that the property is expected to yield. It acts as a measure of guessing the capability of a property to generate profits. The property is seriously or at least compared with other ones by investors to use their judgment in determining the risks and returns of investment.

Cap rate analyzes how much income a real property is projected to generate compared to its market value. A higher Capitalization Rate typically represents a property that earns potentially more returns but with a more unpredictable outcome. In contrast, a lower is generally linked to a moderate investment with a potentially low return. The cap rate definition is a rule of thumb that investors follow frequently when deciding to buy, sell, or hold commercial properties.

How Can You Calculate Cap Rate for Commercial Real Estate?

To calculate the cap rate for a commercial real estate property, you need two critical pieces of information: a capitalization rate that is based on NOI and the property’s current market value (or purchase price).

The cap rate formula is as follows:

Net Operating Income

Cap Rate = —————————

Current market value

Where:

Net Operating Income (NOI): is sought-after income revenue from rents and other sources deducted from operating expenses, which consist of property management fees, maintenance, insurance, and property tax. It does not include the costs of borrowing or the expenses of acquiring capital.

Current Market Value: The simply current value of the internally owned property determined by the market, which depends on recent sales of similar properties, an appraisal, or another method.

What is a Good Cap Rate For Commercial Real Estate?

Defining a reasonable cap rate for commercial real estate investment is a matter of opinion since factors such as property type, location, or market conditions may affect the process of decision-making and, as a result, individual investors may determine a reasonable based on their own goals and risk tolerance. However, here are some factors which you should be aware about.

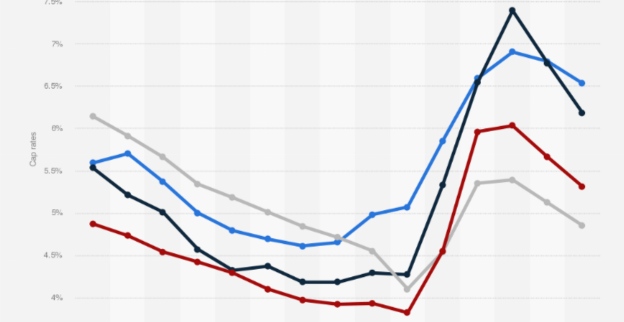

1. Market Averages

Under normal or trotted conditions, cap rates fluctuate between 5% and 10%. It will depend on whether the building (e.g., retail, office, industrial, or multifamily) is in the central business district, mixed-use district, or the infill development around the transit node.

2. Higher Cap Rates

Properties with cap rates of 8.0-10.0 % and above become more attractive because they potentially have higher returns but with a greater risk. The reason might be an undesirable area, a higher vacancy rate, or considerable repairs and upgrades.

3. Lower Cap Rates

Cap rates (e.g., less than 5-6 percent) appeal to those seeking stability and accepting lower-risk investments. Such properties are generally found at preferred locations and may be properties with long-term contracts that have improved leases from stable tenants. Investors may give up some income or lower returns in favor of the stability and low-risk factor that these properties offer.

4. Investor’s Risk Tolerance

A “fine” CAP rate depends on an investor’s risk tolerance. Risk-averse investors may invest in properties with low for a unique stability purpose, while those at ease with taking risks might invest in properties with cap rates as high as they can get to undertake high returns.

What Factors Affect the Cap Rate?

The cap rate commercial real estate is affected by various factors, whether these are associated with the property or something regarding it outside the commercial real estate process. Properly assessing these factors is cardinal in gauging the yield that one could expect from a property investment. Key factors that affect the include the following.

1. Location

The locality or location of a property can determine its cap rate by its neighborhood. A location in an attractive neighborhood and high-demand area means a higher price for the property, which means a possibility of sustainable income.

2. Property Type

Commercial properties categorized into multiple types, such as office, retail, industry, and multifamily, come with different discount rates to represent their cash flow clarity and market demand. For instance, apartment blocks can offer small investors opportunities based on their stable rental flow.

3. Market Conditions

While market trends and economic conditions can impact the level of cap rates employed in certain transactions, these variations are subject to business cycles and individual property attributes. In a booming real estate market, are mainly high. On the other hand, during a down market, cap rates are generally low.

4. Risk Profile

The risk associated with a property can also affect the cap rate, as a low cap rate usually indicates a high-risk investment. Predominantly unoccupied buildings (e.g., those with inferior tenants, weak tenants, or less desirable locations) probably have higher cap rates.

5. Interest Rates

The movement of interest rates may also cause a shift in cap rates. Lowering the interest rates would also mean the cap rates can come down because investors will not object as they will have cheaper financing methods.

6. Property Condition and Age

Striking a balance between renting out aged or older properties and those in good shape, which hardly have much maintenance, could result in low ] Higher-quality tenants could also be attracted to these newer facilities. On the other hand, older properties can cause more maintenance troubles and face higher potential vacancies, leading to lower yields.

What is the Importance of Cap Rate in Commercial Real Estate?

The capitalization rate is significant in commercial real estate for at least a few reasons. It offers meaningful information regarding future gains or losses that will enable the investors to make a knowledgeable choice between buying, selling, or Managing a property. Here’s why the cap rate is significant in commercial real estate

1. Assessment of Investment Potential

The cap rate allows a rapid evaluation of a property’s chances of success. Investors should revise the property’s against similar ones in the market. Thus, it will be easy for them to distinguish a good investment opportunity from a bad one.

2. Risk Evaluation

The cap rate provides an investment risk parameter, helping to understand the investment’s risk. The at the lower boundary perceive higher risk and potentially more returns, while the with highs seemingly mean greater risk and, consequently, lower yield.

3. Comparison Tool

Cap rates allow comparison of properties within the same town or across multiple towns. Through this comparison, shareholders can decide which possessions offer the best returns in relation to the risk among the physical framework.

4. Valuation

The cap rate is the benchmark of the property market by which its value is estimated most frequently based on its income-generating opportunity. This gives you an idea about the figure at which a particular property should be sold, considering the probable rental income.

5. Investment Strategy Alignment

Through cap rate comprehension, investors can see an investment’s risks and relate them to their objectives and tolerance. For example, one investor may value a lower for stability, while others may target high for likely high returns.

6. Financing Decisions

When reviewing financing proposals, lenders and investors usually use cap rates to evaluate risk and overall profitability. Commercial locations could be perceived as more desirable while seeking loans, as longevity and predictability attract investors.

Find the Best Real Estate Property with a High Yield and Cap Rate In NYC

Real Estate Property, Commercial Real Estate

Cap rate is one of the most vital profitability indicators. It summarizes future returns from a property investment. Property Investors can calculate the long-term yield and associated risks and make wise decisions about property ownership. We discuss all aspects related to and its importance in detail. However, one can find it challenging to calculate the and decide which property is best compared to others.

Collaborating with qualified commercial real estate firms like Citadel Property Management Corp. investors can ascertain or decipher the and other intricate components in the commercial property sector. The management corporation provides mapping and financial analyses of properties, ascertains risk and revenue factors, and helps the investor invest in the most feasible property.

FAQs

1. What is the limitation of the cap rate?

The limitation of the cap rate is that it does not consider depreciation or other structural changes.

2. What does a 6% cap rate mean?

It means that the property can yield a return of 6%.

3. Are cap rate and ROI the same concept?

No, cap rate and ROI are two different concepts.

4. Is 8.5% is a good cap rate?

Yes, 8.5% is a good cap rate.

5. Can the cap rate be negative?

In theory, it is possible that the cap rate can be negative.