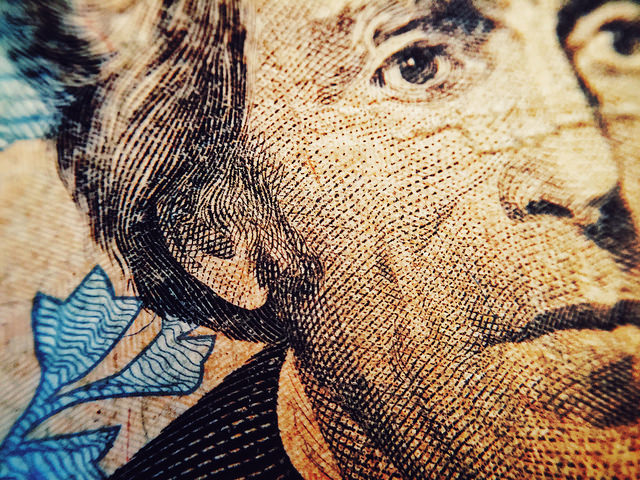

Coming up with a down payment can be a struggle, especially for first-time buyers. That’s because – unlike repeat buyers who can use the sale of their current house to help fund their new home – first timers have to come up with the money the old fashioned way. That means, saving it – which can sometimes be an obstacle for younger buyers. A new report from realtor.com takes a look at just how much you’d need to set aside each day in order to save up the average down payment in each of the country’s 15 largest metro areas. To calculate this, they took the median listing price and average down payment in each area, then figured out how much you’d need to save each day over 5 and 10 year periods. For example, to save the average down payment on a median-priced home in the New York metro area, you’d have to save $19.49 every day for 10 years. On the other hand, saving the same amount each day would be enough to come up with a down payment in Phoenix in just 5 years. But what if you don’t have $20 to put away each and every day? Well the article recommends things like putting aside tax refunds and work bonuses, picking up a weekend job, or cutting back on spending. More here.